Mutual funds (mutual funds): what is it, how do they work and is it possible to make money on them

In search of a profitable investment option, novice private investors try a lot and, as a rule, invest individually, choosing suitable instruments for themselves according to the investment threshold, profitability and risks. Mutual funds stand out noticeably against the background of the variety of different ways of investing, allowing you to open up new opportunities. As a diversification, this method of investing capital can be used by many investors. Therefore, capital holders interested in income should know what mutual funds are and how to make money on them.

What are mutual funds in simple words

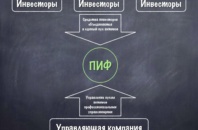

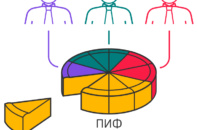

The abbreviation mutual fund stands for mutual investment fund. The latter is a form of collective investment, in which funds are held in trust, and the shareholders themselves acquire income upon repayment of the share. The fund, which receives remuneration for the management of shareholders’ funds, also remains out of pocket.

Due to the fact that the fund’s assets are managed by professionals, a private investor does not need to monitor the situation on the stock market, monitor quotes and news or develop their own strategies. The features of this form of collective investment are the following points:

- in addition to obtaining a certain yield, the acquired share can be sold or mortgaged. Over time, as a rule, the price of a previously purchased share increases;

- the assets of shareholders are protected at the legislative level, and the activities of management companies are under the close attention of regulatory authorities, including the Central Bank. This feature prevents the possibility of curtailing the activities of funds and the flight of managers with the assets of shareholders.

Advantages of mutual funds

The answer to the question of why investors choose mutual funds lies in their advantages. And that’s what they are:

- high, though not guaranteed profitability, which is achieved in particular due to a wide range of investment instruments in the portfolio of the Management Company;

- no need for personal participation in the process. Simply put, for an investor who bought a share in a mutual fund, the management Company does everything, and at a professional level;

- the opportunity to get acquainted with the results of activities. This can be done monthly by studying the reports, which are posted on the fund’s website.;

- high level of reliability. In this case, it is assumed not only control over the activities of companies, but also their own interests. It is simply unprofitable for the Criminal Code to bankrupt funds, because in this case they will lose both customers, their remuneration, and business reputation;

- no need to incur expenses. If, for example, the fund loses the court and has to pay a fine, penalties and penalties, it will pay at its own expense, and not at the expense of shareholders;

- limitation of expenses, which means a fixed amount of remuneration and the possibility of refund of overpayment if the CC exceeds the cost limit;

- the right of shareholders to change the Criminal Code. Such a decision is made at the general meeting by shareholders owning at least 10% of all shares;

- the possibility of replacing shares in one mutual fund with shares in another. Since one management company can manage several funds at the same time, an investor who owns shares in these funds acquires the right to exchange.

Types of mutual funds

Depending on the status of shareholders, there are capital funds and funds for unqualified investors. It is believed that the participants of a qualified (heavy) mutual fund are willing to take big risks, which implies a wider portfolio and the possibility of voting before concluding a deal. Shareholders of an unqualified fund do not make significant decisions, the Criminal Code does it for them.

By specialization , you can distinguish:

- Real estate mutual funds that invest investors’ funds in the acquisition of property that can bring income. In this case, the Criminal Code acquires real estate that can be resold or leased.

- Mutual funds of financial market instruments specializing in stock exchange speculation with money, loans, shares, securities.

- Combined mutual funds, in whose assets anything can go, with the exception of cash.

Based on the terms of purchase and repayment of shares, it is possible to designate:

- open-ended funds that do not have a finite number of units that can be bought at any time;

- interval funds in which the deadlines for submitting an application for the purchase of shares are prescribed in the rules;

- closed, shares in which it is allowed to acquire only at the stage of formation of the fund or at the time of their additional issuance.

How to make money on mutual funds

A private investor earns on the growth of the value of the fund’s shares. In turn, the profitability of a particular fund depends on the growth (decrease) in the value of its assets. In this regard, you can really earn as follows:

- Invest for the future. An investor can earn money if he invests in the purchase of shares at the stage of reducing their value. This strategy allows you to purchase shares at a lower price, and when there is an increase in value, sell them more expensive.

- Diversify the portfolio. This strategy involves increasing profitability by exchanging or adding shares. For example, an investor’s portfolio may include mutual fund units, some of which specialize in conservative assets, others in riskier ones.

Mutual fund profitability

The amount of profit of any mutual fund directly depends on the growth (decrease) in the value of assets and their composition. In turn, the change in the value of assets is influenced by many factors, for example, the change in the size of the key rate, the decline in oil prices, the policy of the Central Bank in different countries, crises, the level of experience of the manager and other global and internal factors. Therefore, it is almost impossible to predict the benefits of investing in a particular fund.

The difference between a mutual fund and a deposit

Firstly, the volume of collective investments is greater than the volume of investments of one bank depositor, therefore, the total income of the fund is greater. The bank, like the fund, invests depositors’ funds, but pays only a fixed percentage. Thus, the profitability of a mutual fund with proper management can be much higher.

The second difference is in the directions of use of funds. Banks for the most part earn on interest by crediting borrowers at the expense of depositors. The possibilities of mutual funds are much wider. Their assets comprise a wide variety of products that can not only generate regular income, but also compensate for losses.

Main risks

The main drawback of the mutual fund immediately catches the eye – the lack of guarantees of obtaining a stable income. There is a great risk of coming across a criminal code that was created artificially in order to save money on paying taxes. And in this part, a lot of responsibility falls on the shareholder, who should not just invest money and forget about them for several years, but from time to time inquire about how things are going in the Criminal Code, about its plans, strategies and forecasts. If things are not very good, it makes sense to dilute your portfolio with shares of other, more profitable funds.

As for the protection of shareholders’ funds, there are zero risks due to the fact that the activities of the Criminal Code are under strict control of the regulator. There is no need to worry about a complete collapse, since it is impossible for the value of all the fund’s assets to fall or all issuers to go bankrupt at the same time.

Important! Any investment involves risks.

The investor himself makes a decision on investing personal funds in a specific profitable instrument. It is not recommended to use borrowed funds for these purposes, or amounts whose loss will significantly worsen the financial situation of the investor.

Published: 14 April, 2022