What does a bull and bear market mean: characteristics, trend change, what should an investor do

To trade successfully, you need at least a good understanding of the basic concepts of the financial market. For example, terms such as “bullish” and “bearish” market will tell an experienced trader a lot, while a beginner will simply get confused. Next, let’s talk about the “bulls” and “bears” on the stock exchange, what features the market has, including cryptocurrency, and how to determine the current trend.

What does “bulls” and “bears” mean on the stock exchange

These terms are not new. Back in the XVIII century, in stock trading, bulls were called investors who played on the price increase, and bears were those who played on the decline.

Investors who are confident that the value of an asset will grow, earn on the growth of quotations. They are considered bulls, but in fact they are buyers. Investors acting in contrast to the bulls, convinced of the fall in the value of the asset, earn on the fall. They open positions for sale and they are called bears.

Bullish and bearish trend: the main characteristics

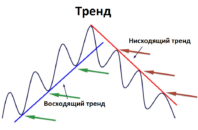

In short, the difference between a “bullish” trend and a “bearish” one is that in the first case, the price growth trend prevails in the market, that is, an upward trend, in the second there is a downward trend in the price, that is, a downward trend.

Supply and demand for securities

The period of a bearish trend in the market is accompanied by a general economic downturn or a slowdown in economic growth. Therefore, the value of securities may fall by 20 percent or more. Such a market is characterized by an increase in trading volumes and increased volatility. Sellers gain an advantage over buyers, which means the supply is growing. At a certain point, the price of assets reaches the limit value, which makes their further sale unprofitable.

When the economy begins to gain momentum, the “bearish” trend is gradually replaced by a “bullish” one. The price of assets is growing against the background of positive news, volatility is decreasing, and more and more buy positions are being opened on the market. During this period, demand is growing rapidly.

Psychology of market participants

Such is understood as a set of rules, principles and behavioral strategies that help market players make the right decisions. In practice, this is not easy, since the emotional component interferes with the process. Here it is important to find the golden mean, the optimal trading strategy for yourself or follow the general trend.

The “bearish” trend is always replaced by a “bullish” trend and there is a certain pattern in this. If you adapt to the constantly changing market and learn how to correctly analyze its trends, you can find a balance between fear and greed. The first is just inherent in the “bearish” market, the second characterizes the “bullish”.

Changes in economic activity

From the point of view of psychology, a bull market is an optimistic market. During such periods, there is an increase in the value of company shares, an economic recovery, and a high level of employment. Traders believe in the duration of the uptrend and actively buy, opening long positions.

The “bearish” market, on the contrary, is characterized by pessimistic sentiments. The economy is experiencing difficulties during such periods, unemployment is rising, quotations are falling, investors are taking a wait-and-see position: they get rid of illiquid assets and wait for the market to turn around.

Why is it important to understand

Only a small part of traders and investors are willing to take risks. The rest, not being professionals and not having insider information, adhere to the psychology of the majority. And this makes sense, because if everyone is buying, and the price is rising, it is more profitable to join the general trend. Conversely, when a downtrend prevails in the market, it is wiser to sell in order not to incur even greater losses.

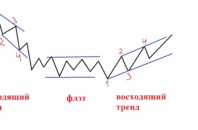

Important! During the flat period, when the trend is not clearly defined, and the price moves sideways, it is better not to conclude deals, but wait until the market decides.

Bullish or bearish trend – how to determine

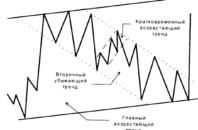

Both of these trends are determined using the same tools: trend lines, special indicators and even visual analysis of the chart. In the latter case, with a downward “bearish” trend, each subsequent low (the lowest price level for a certain period) is lower than the previous one. The same is observed with respect to hi (the highest level reached by the price). With a bullish trend, the opposite trend can be traced.

Visual analysis allows you to understand the direction of the market, but unfortunately, it does not give a clear signal of a trend change. That is why the Moving Average and Parabolic SAR indicators should be connected for analysis.

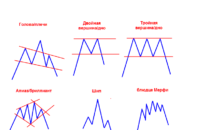

What should an investor do when the trend changes

The moment of trend reversal is a signal to make a deal in order to get the maximum profit.

And here are some tips to help implement the plan:

- make sure that this is a trend change, not a temporary correction;

- close the positions opened during the previous trend (we fix the profit);

- open positions in the direction of a new trend, including placing pending orders. At the same time, it is important to additionally place orders to limit losses if the trend does not change.

Despite the apparent simplicity, not every trader is able to determine with absolute accuracy the movement of the market and, most importantly, the change of one trend to another. That is why sometimes it is more correct to take into account the general mood in the market, rather than succumb to momentary weaknesses.

Published: 5 May, 2022