How to trade on the Forex market: instructions for beginners

Almost every user who is attracted by the great opportunities of this line of online activity will be able to master the profession of a trader. And for this it is not necessary to spend a large amount of money on training. To start, it is enough to familiarize yourself with this instruction, which will allow you to understand the principle of working in the Forex market.

The main advantages of working as a trader:

- Free schedule. The trading platform is open around the clock. You can make currency transactions at any convenient time.

- Not tied to a specific place. You can trade from anywhere in the world.

- Absence of superiors.

- The income is unlimited, the amount of earnings depends only on the user.

- Minimum initial investments. A thousand rubles is enough to enter the market.

How do they earn money on the Forex market?

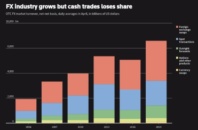

The international financial Forex market is an online platform where a huge number of users earn on the difference in the value of currency pairs. It can become a source of solid income for those who know how to play on the difference in courses, constantly developing and improving their knowledge, extracting a decent profit from it.

According to many participants, the Forex market is an attractive investment tool that, with the right approach, allows you to earn up to 30-50% with minimal risks. Successful traders claim, with good reason, that with a competent increase in risks, it is quite realistic to receive more than 100% per year.

To understand the principle of trading, let’s give a simple example.

As an example, let’s take not a currency pair, but, for example, a bag of grain. The cost at the moment of which is 100 rubles. There are two ways to make money on it:

- If the merchant believes that in the near future the price of it will rise, then you can make a deal by buying it for 100 rubles, and after a while, sell it for 120 rubles. The difference of 20 rubles will make a profit.

- If, according to the entrepreneur, the price of a bag of grain will fall over time, you can make a “short sale” transaction. To do this, you will need:take the goods, in this case, a bag of grain;

- sell it at the current exchange rate for 100 rubles;

- after the price reduction, buy back at the new price for 80 rubles;

- to return the goods borrowed.

The profit will be 20 rubles again.

Approximately the same thing will have to be done in the Forex market – to earn both on an increase and a decrease in the exchange rate, i.e. buy cheaper and sell more expensive, or borrow goods, sell at a higher price and buy back when the price of it falls.

Only, unlike this example, all actions on Forex are automated:

- transactions are carried out almost instantly;

- buying or selling is carried out through simple management;

- the borrowed goods are provided automatically, and after the transaction, also without the participation of the user, they are handed back;

- access to the market is round-the-clock, as the main currency platforms operate in all time zones;

- the calculation of trading results is carried out automatically;

- access to free exchange rate forecasting methods and currency information.

Fundamentals of the Forex market

Currency pairs act as a commodity on Forex. Market participants are:

- commercial firms and individuals engaged in import/export activities with foreign partners. By the nature of their activity, they need to buy and sell foreign currency in exchange for goods or components for their production. Forex allows them to convert foreign currency, protecting themselves from future fluctuations in exchange rates;

- investors who use it as a currency exchange point to invest in foreign stocks;

- speculators, represented by private traders, trading with the use of personal capital, or attracted funds, in order to make money on the difference in exchange rates.

Each currency pair has its own designation. There are about 70 of them in total. The most common currency pair is euro/dollar. The euro/US dollar exchange rate looks like EUR/USD. This designation indicates that euros are bought and sold for dollars.

The price looks like this:

For example, the price for the EUR/USD currency pair is 1.23. This means that for one euro, a market participant will have to pay 1 whole and 23 hundredths of US dollars.

The trader should understand that everything that concerns the fall and rise of the exchange rate refers to the first currency of the pair of interest. In this case, it is the euro. For example, if the price of EUR/USD has increased from 1.23 to 1.25, it means that the trader will have to pay more US dollars. Information about the decline in the exchange rate from 1.23 to 1.20 suggests that the price of the euro has fallen and it is now being given less American currency.

A similar scheme works for other currency pairs, i.e. all the information that is subject to change in the pair refers to the first currency.

The minimum possible price change is one point. It is equal to one ten thousandth. For example, a price change from 1.2300 to 1.2301 is an increase of 1 point. As a rule, it is the same for everyone – 0.0001. But there is an exception. One point in a currency pair, where the Japanese yen is in second place (for example, Usd / Jpy, Eur/ Jpy, etc.), is 0.01.

It is worth mentioning one more feature that a trader should know. In currency pairs, the US dollar is in second place, for example, Eur/ Usd, Gbp /Usd, one point is equal to 10 rubles. It turns out that if the trader guessed the course, then for each correctly predicted point he receives 10 rubles of profit. If the forecast turned out to be unprofitable, he loses the same amount for each point.

The user does not have to calculate profits and losses manually, the program does all this by giving out the final figures.

Features of making forecasts for Forex trading

The main object of transactions of a private trader in the Forex market is the dynamics of changes in exchange rates. For many, such speculative activity becomes a profession that allows you to get a very good income.

In order to understand when to sell and when to buy a currency, the user must learn how to predict the movement of exchange rates. Two methods are most often used:

- Technical analysis. It consists in analyzing the price movement chart of currencies, searching for patterns through the use of special financial indicators, etc.

- Fundamental analysis. Making forecasts based on macroeconomic statistics, the political situation in the world, statements of regulators, etc.

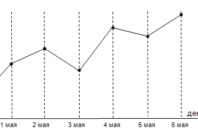

Let’s analyze the price charts. Most often, users are used to seeing the following option:

in this case, each point indicates the price indicator on the specified day.

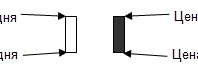

The price during the day is indicated in a slightly different way. Most often, the so-called Japanese candle method is used for these purposes. This indicator is recorded at least four times a day:

- price at the beginning of the day;

- minimum daily value;

- maximum daily value;

- price at the end of the day.

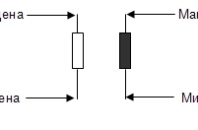

Then, based on these data, rectangles are constructed that differ from each other in color. In the case of an increase in the daily indicator, a light geometric element is built. If the price for the day has fallen – dark. The boundaries are denoted as follows:

The maximum values of daily indicators are plotted on the chart in the form of vertical lines coming from rectangles:

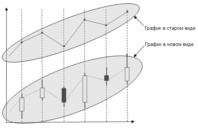

In general , the graph looks like this:

It is possible to fix price indicators in this way not only during the day, but also in other time intervals, for example, for 4 hours, for an hour, for half an hour, for 5 minutes, etc.

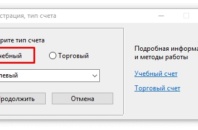

Experienced traders use special software to automate the process of constructing such charts. For example, the TradingDesk Pro 5 trading terminal. For familiarization, beginners are recommended to use a “training” profile. It has all the functionality that is available in the “trading” account. Thanks to this, a novice trader will be able to master the basics of trading at the expense of a virtual account.

Installation and registration in the program is simple. After opening, a window will appear in which you need to go to the “Registration” tab, fill in the fields provided, confirm the input, then select the “training” account and “send” the data.

After successful registration, you can log in with your username and password and start trading using virtual funds.

Analysis of the first indicator

You should not try to guess with the help of intuition where the graph will go. All calculations and decisions must be made on the basis of the data provided.

There are two charts in TradingDesk Pro 5.

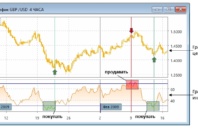

The upper one is the price chart, the lower one is the chart of a special indicator.

The indicator is a formula that transforms or smoothes the price criterion of the main chart.

The screenshot above shows the RSI indicator, according to its data it is possible to predict the market. The evaluation criterion is two lines located at the level of marks 30 and 70. According to the general rule laid down in the principle of operation of this indicator: if the indicator rose above 70, and then went into decline – it is worth selling, if it fell below 30 units, and then began to grow – it’s time to buy.

In this case, judging by the chart, the RSI indicator gives fairly clear signals which kind of deal should be carried out, predicting the likely price dynamics.

There are a lot of such classical indicators. All of them predict, using a certain calculation formula, the movement of the exchange rate with one degree or another. As traders gain experience, they can create their own oscillators.

How to make Forex transactions?

Earnings on the online platform in question are based on the purchase and sale of currency. A single transaction is called a transaction.

The main task of a trader is to open a potentially successful deal, after closing which, he will be able to make a profit.

An open position is a transaction that has not yet been closed by the trader with a reverse operation. I.e., as long as after buying one currency, the trader expects a price change, it is considered open. During this time, he has the opportunity to get a positive or negative result. After the user performs the reverse operation, i.e. sells the purchased currency back and receives the final result (profit or loss), the transaction will be closed.

Closed position – for which the trader performed a reverse operation and the result of the transaction was recorded.

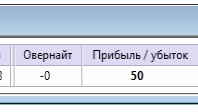

Account status during the transaction

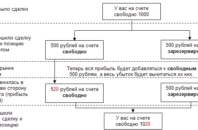

For example, a trader has 1000 rubles on his account. According to the trading rules, 500 rubles are reserved on the account for any open position with a volume of 100,000. When closing a trading operation, the account changes look like this:

As can be seen from the diagram, when the trading operation is closed and the result is fixed, the previously reserved 500 rubles become available again for the next transaction.

Important! In case of a negative outcome of an open transaction, if the loss is equal to or greater than the available funds available on the trader’s account, the operation will be closed automatically, and the result will be recorded.

For example, there are 1300 rubles on the account. When opening a trading operation, 500 rubles are reserved from the account, and 800 rubles remain free. If the loss on the position in question is 800 rubles or more, the transaction will be closed automatically, the trader will lose the amount available on the account, and 500 rubles will return to the account.

Advice from experienced traders: do not start trading large volumes at once, especially if the account has a small amount. In this case, even a minimal movement of the market towards a loss will lead to the automatic closing of the operation and fixing the negative result of the transaction.

How to make the first Forex transaction?

First of all, you need to launch the installed trading terminal TradingDesk Pro 5 and log in to it with your username and password. After successful authorization, the main window of the program will open to the user.

All transactions made on the “training” account do not oblige the trader to anything, so you should not be afraid to make decisions.

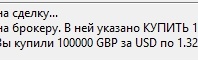

For example, take the GBP/USD currency pair (the rate of the British pound to the US dollar). Now you need to familiarize yourself with the chart, and after analyzing it, try to predict further price movement.

After double-clicking on the “Quotation Table” for the selected GBP/USD pair

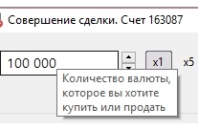

the trading operation form will open

Almost all elements of the program window have tooltips. To make them appear, you need to hover the mouse cursor.

To open a position, the trader needs to select the desired operation “Buy” or “Sell”. Upon successful opening of the transaction, the corresponding inscription will appear:

You can track the status of a trading operation in the “Tables” tab (located at the bottom of the screen).

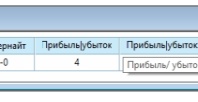

The information on the transaction is in the “Open positions” and has the form:

There are two ways to close a trading operation:

- Go back to the “Quotation Table”, click on the currency pair and make the opposite transaction.

- In the “Open Positions” table, click on the “Position No.” column, and in the window that opens, select the desired operation (buy or sell). Only one button will be active to complete the transaction (the opposite operation).

After closing a trading operation, information on the completed transaction will appear in the “Closed Positions” table (the same “Tables” tab).

The result of the completed transaction and its numerical value will be visible in the tenth column “Profit/Loss”.

The opening of any trading operation, especially when working with a real account, should be preceded by a serious analysis of the current state of the market, using all available technical and fundamental analysis tools. Only a serious approach is the basis for a successful entry into the market and obtaining a stable profit from trading.

Published: 23 July, 2021