Most crypto users discover projects only after the price chart appears.

Testnet airdrops work in the opposite direction – they reward people who enter before speculation begins, when the product is still being built.

This guide explains what testnet airdrops really are, why serious projects rely on them, and how you can use them as a strategic early-access system rather than random luck.

What a Testnet Actually Is

A testnet is not “a demo chain.”

It is a full blockchain environment designed to simulate real economic conditions without risking real capital.

On testnets developers can:

- deploy smart contracts

- simulate transaction congestion

- measure validator behavior

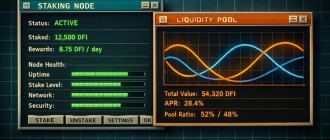

- test bridges, staking, governance and liquidity logic

- stress security models

For users, a testnet becomes a sandbox economy – a place where mistakes cost nothing but activity can later turn into value.

What Testnet Airdrops Really Are

Testnet airdrops are delayed reward programs.

Instead of paying you instantly, projects record your behavior over time and reward wallets that meaningfully contributed to network testing.

You are not rewarded for clicking buttons.

You are rewarded for becoming part of the system’s behavioral data layer.

Why Serious Projects Use Testnet Airdrops

Modern blockchains are too complex to be launched blindly.

Projects use testnet airdrops to:

- identify real usage patterns

- find economic vulnerabilities

- optimize fees and throughput

- measure community decentralization

- pre-build organic liquidity behavior

- distribute tokens to users instead of VCs

Testnet participants essentially become the first real economic layer of the chain.

How Testnet Airdrops Work (Real Flow)

- Project launches public testnet

- Faucets distribute test tokens

- Users interact with dApps, bridges, staking, swaps

- Network records long-term behavior

- Project launches mainnet

- Snapshots are taken

- Qualified wallets receive real tokens

This is not a lottery – it is a behavior-based allocation system.

Why Testnet Airdrops Are Powerful

Testnet participation positions you before market narratives exist.

You are entering when:

- token price is unknown

- VC unlock schedules are invisible

- influencers have no charts to sell

- speculation does not distort behavior

This is where asymmetric opportunity lives.

Types of Testnets

| Type | Purpose |

|---|---|

| Public | Open networks for all users |

| Private | Enterprise or closed testing |

| PoW | Mining & validator stress testing |

| PoS | Governance & staking simulation |

| Smart-Contract | DApp security testing |

| Cross-Chain | Bridge and interoperability testing |

Testnet vs Mainnet

| Feature | Testnet | Mainnet |

|---|---|---|

| Token value | None | Real |

| Financial risk | Zero | High |

| Purpose | Simulation | Real economy |

| Access | Open | Open |

Where Real Testnet Opportunities Come From

- GitHub development logs

- Discord technical channels

- Core developer Twitter accounts

- Ecosystem launch calendars

- Early-stage chain announcements

The best airdrops never trend on TikTok.

Pros and Cons

Pros

– No capital risk

– Early network positioning

– Long-term asymmetric upside

– Deep ecosystem understanding

Cons

– Requires consistency

– No guaranteed reward

– Delayed gratification

Final Thought

Testnet airdrops are not free money.

They are a behavior-based entry system into future economies.

People who treat them like faucets lose.

People who treat them like early economic layers win.