Many people enter crypto believing that trading is the only way to make money.

Charts, signals, leverage, endless scrolling through Twitter — it feels like the default path.

But the truth is simpler and less dramatic: most long-term crypto participants do not earn primarily from trading.

They earn from infrastructure.

Crypto is not just a market.

It is an ecosystem where capital, technology and behavior interact.

And inside that ecosystem, there are multiple ways to earn without predicting price movements.

However, every method that looks “passive” hides its own type of risk.

Understanding these trade-offs is the difference between sustainable income and slow capital erosion.

The Myth of “Passive” Crypto Income

Crypto communities love the word passive.

Staking looks passive.

Yield farming looks passive.

Airdrops feel passive.

But in reality, crypto income is rarely passive.

It is deferred risk.

You are not escaping volatility — you are relocating it.

Once you understand this, earning crypto without trading becomes a strategic decision, not a fantasy.

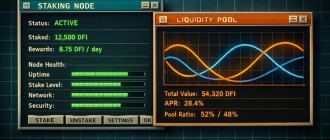

Staking: The Most Intuitive Entry Point

Staking is usually the first non-trading income method people encounter.

You lock tokens in a blockchain network and receive rewards for supporting validation and security.

It feels simple, predictable, and relatively safe compared to active trading.

But staking is not risk-free.

If the token price falls faster than rewards accumulate, your real return becomes negative.

If a network faces technical or governance issues, staking returns can shrink or disappear.

Staking is not about beating the market.

It is about staying exposed to it with reduced effort.

DeFi Yield: Higher Returns, Higher Complexity

Decentralized finance offers more aggressive ways to earn.

Providing liquidity, lending assets, participating in protocol incentives — these mechanisms can generate attractive yields without direct trading.

But DeFi rewards are not free.

Smart contract vulnerabilities, impermanent loss, protocol failures and incentive dilution are structural risks.

Many users discover that high APY often compensates for hidden fragility.

DeFi income is closer to running a micro financial strategy than collecting interest.

Airdrops and Points Programs: Time as Capital

Airdrops feel like the purest form of earning without trading.

You use protocols early, interact with ecosystems, and sometimes receive tokens later.

But here the real cost is time and attention.

Most projects never distribute meaningful rewards.

Some reward only a tiny fraction of users.

Others change rules mid-cycle.

In airdrop farming, your capital is not money — it is behavioral data.

Running Infrastructure: The Quiet Professional Path

More advanced participants earn by operating infrastructure.

Validators, nodes, indexing services, data providers — these roles do not depend on price predictions but on technical reliability.

This path is less visible on social media, but often more sustainable.

It also requires knowledge, capital and long-term commitment.

Infrastructure income is slow, boring and powerful.

Which is exactly why most people ignore it.

The Hidden Risk Nobody Talks About

Every non-trading income method shares one silent risk: correlation.

When markets crash, yields drop, token prices fall, DeFi activity shrinks and airdrops lose value simultaneously.

Earning without trading does not mean earning without exposure.

Crypto rewards are tied to crypto cycles.

A More Realistic Way to Think About Crypto Income

Instead of asking:

“How can I earn without trading?”

A better question is:

“How much volatility am I willing to accept in exchange for predictable behavior?”

Staking trades volatility for stability.

DeFi trades simplicity for yield.

Airdrops trade time for optionality.

Infrastructure trades complexity for durability.

There is no free option — only different risk profiles.

Final Thought

Crypto rewards those who build systems, not those who chase moments.

Trading is loud.

Earning through participation is quiet.

Most portfolios that survive multiple cycles are not built on perfect trades, but on consistent exposure to the ecosystem’s economic flows.

Understanding how to earn crypto without trading is not about avoiding risk.

It is about choosing the kind of risk you can actually live with.