Most crypto traders think their problem is finding better entries.

In reality, their problem is almost always size.

A single oversized position can destroy months of discipline. A small, well-calculated position can survive mistakes, bad timing, and unpredictable news. Position sizing is the quiet mechanism that decides whether you stay in the game long enough to win.

Markets do not punish bad ideas — they punish bad size.

Why Size Matters More Than Entries

Crypto volatility makes traditional trading rules brutal.

A move that looks small on a chart can wipe out leverage accounts and force emotional decisions in spot portfolios.

Two people can buy the same token at the same price and get opposite outcomes. The difference is not analysis — it is how much they risked.

Position sizing crypto is not about maximizing profit.

It is about controlling damage.

The Hidden Math of Survival

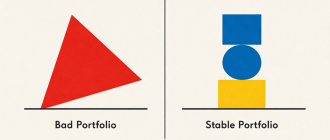

Every portfolio has a breaking point. If one trade is too large, you lose the ability to think clearly. You stop managing risk and start negotiating with the market.

Good size creates psychological distance.

Bad size creates panic.

Professional traders survive dozens of small losses because no single position defines them. Beginners often lose everything because one trade is allowed to become an identity.

Thinking in Risk, Not in Coins

Most people ask, “How many tokens should I buy?”

The correct question is, “How much of my capital can I afford to lose if I am wrong?”

Size should be built around risk, not around hope.

A position that looks attractive on paper can still be dangerous if it represents too much of your account. The market does not care about conviction.

Volatility Changes Everything

Crypto moves differently from traditional markets.

A stock dropping ten percent is dramatic.

An altcoin dropping thirty percent is a normal Tuesday.

This means position sizing crypto must be naturally smaller than in other asset classes. What feels conservative in equities can be reckless in digital assets.

The Portfolio, Not the Trade

Thinking in isolated trades is a trap.

Your account is a system of interconnected risks.

A wallet filled with highly correlated altcoins is effectively one giant position, even if it looks diversified. True sizing considers how assets behave together, not separately.

Leverage Makes Size Louder

Leverage does not create edge.

It only amplifies mistakes.

Many accounts blow up not because the idea was bad, but because the size was multiplied beyond what the trader could emotionally manage. Leverage turns normal volatility into existential threat.

Building a Personal Framework

Position sizing is personal.

It depends on:

- your time horizon

- your income stability

- your experience with volatility

- your emotional tolerance

A good size is one that lets you sleep and think clearly, even when the market moves against you.

Final Thoughts

There is no perfect entry.

There is only survivable size.

If you control size, you can be wrong and stay alive.

If you ignore size, one trade will eventually end your story.

In crypto, longevity is the real strategy — and position sizing is how you buy it.